how to claim medical expenses

Every US citizen will know what his Adjusted Gross Income AGI. How to claim the medical expense deduction Youll need to take the following steps.

Are Medical Expenses Tax Deductible Turbotax Tax Tips Videos

This will tell you how much can be deducted.

. First you need to get IRS form 1040 and then attach Schedule A along with the form and submit for a Tax deduction. If public transportation isnt available you may be able to claim vehicle expenses. Yourself your spouse or common-law partner.

How do you claim medical expenses. The first one is arguably the most well-known type of medical expense. Enter the differences on line 4.

These can be your own health expenses those of a family member or any individuals as long as you paid for them. Overview You can claim relief on the cost of health expenses. You can only claim for expenses that you have receipts for.

Line 33099 You can claim the total eligible medical expenses you or your spouse or common-law partner paid for any of the following persons. What is the Procedure for Claiming Exemptions Under Section 80 D while filing Income Tax Returns. Updated December 18 2020.

To claim the medical expense deduction you must itemize your deductions. Say after doing the math the lower-income spouse had 3000 in expenses over the minimum threshold. Now in Schedule A you need to mention the total medical expenses that you have spent during that financial year on the first line.

Report the total medical expenses you paid on line 1 of Schedule A and your AGI from line 38 on Form 1040 on line 2. MEDICAL SERVICES CLAIM FORM Please use this form to claim the cost of medical treatment and travel expenses. You can only claim expenses that you paid during the tax year and you can only deduct medical expenses that exceed 75 of your adjusted gross income AGI in 2020.

Other expenditure necessarily incurred and paid in consequence of any physical disability suffered by you your. Itemizing requires that you dont take the standard deduction. If you traveled at least 40 km one way to get medical services you can claim the cost of public transportation ex.

If they were reimbursed through a health insurance plan for 6000 their out-of-pocket medical expenses would be 4200. For the current tax year you have had 5475 of qualifying medical expenses. If you are PAYE taxpayer you also have the option to claim relief in real time during the year.

The lowest federal tax rate is 15. Health expenses are claimed through your Income Tax IT return. Only Part B of this form needs to be returned to Comcare Comcare pays for reasonable medical hospital pharmaceutical and other treatment costs that are related to your workrelated injury or illness.

Under section 80D it allows the policyholder to save tax by claiming medical insurance incurred on self spouse dependent parents as a deduction from income before paying the taxes. Medical Expenses Claiming procedure in the US. Bus train or taxi fare.

Compensation and Payment. You cannot claim relief for any amounts that you have already received or will receive from. You can claim your medical expenses as a tax credit during the year that you paid for them for yourself your spouse or a dependent.

Exemptions can be claimed for both online and cash payments. Medical Scheme Fees Tax Credit Additional Medical Expenses Tax Credit R12456 R2044. You can claim medical expenses on line 33099 or line 33199 of your tax return under Step 5 Federal tax.

This translates to a refund of 12 for every 60 you pay in GP fees. Although the Income Tax Act permits deductions on medical expenditures but you need to know if you are eligible to claim the benefits while filing your ITR. Also the person should not have any health insurance policy.

So if you visit the doctor three or four times in a year its easy to see how your tax refund can really start to build up. In short every time you visit the doctor youre entitled to claim tax relief at 20. What qualifies as a qualified medical expense.

So if your AGI is 50000 then you can claim the deduction for the amount of medical expenses that exceed 3750. Total Medical Expenses Tax Credit to be applied. 25 x Total qualifying spend plus Excess Medical Schemes Fee - Taxable income x 75 25 x R8176 R2044.

25 x R 6 736. Itemize on your taxes First youll need to itemize instead of. You can claim out-of-pocket health insurance premiums.

One can claim a. Additional Medical Expenses Credit. How do you claim health expenses.

Additional Medical Expenses Credit Total qualifying spend excess schemes credit Taxable Income x 75 R 25 000 R 8 736 - R 360 000 x 75 R 33 736 R 27 000 R 6 736 Remember that the additional medical expenses credit is 25 of the sum of excess fees and qualifying medical expenses so lets work that out. If you have travel expenses related to medical services and you also qualify for northern residents deductions line 25500 of your return you may be able to choose how to claim your expenses. However for expenses incurred on medical treatments and tests.

Total Medical Expenses Tax Credit. Normally you should only claim the medical expenses deduction if your itemized deductions are greater than your standard deduction TurboTax can also do this calculation for you. Alternatively you can email your details to custformrevenueie.

If a medical practitioner certifies in writing that you were not able to travel alone to get medical services you can also claim the transportation and travel expenses of an attendant. How to Claim Medical Expenses. The way to do it is to multiply your adjusted gross income by 0075.

The medical insurance premium payment needs to be done online to qualify for exemption claim under section 80 D. In this case you can now deduct 2100 in medical expenses from your tax return. The results on line 4 will be subtracted from your AGI to show your taxable income.

Updated January 5 2021 - Additional clarifications added for amendments on Deceased claims. Put 10 of your AGI on line 3. You can also claim medical expenses relief offline by completing a paper Form 12 pdf or a Form 12S pdf a simplified version for routine tax returns and returning it to your Revenue office.

If you traveled more than 80 km one way you can claim vehicle expenses accommodation meals and parking. The persons age should be 60 years or above to be eligible to claim the medical expenses. Any policy of insurance.

You can view an entire list of eligible medical expenses on the Government of Canadas website. You need to enter. The calculation is the same regardless of your adjusted gross income.

You can request a Form 12 or a Form 12S by calling Revenue at 01 738 3675. These expenses include prescription medication prescribed medical tests etc. Expenses paid in respect of medical services and prescribed medical supplies for yourself your spouse your or your spouses children or your dependants as described qualifying medical expenses.

However for many services Comcare may use fee schedules set. You can claim relief on health expenses through myAccount or Revenue Online Service ROS.

Medical Expense Deduction How To Claim A Tax Deduction For Medical Expenses Bankrate

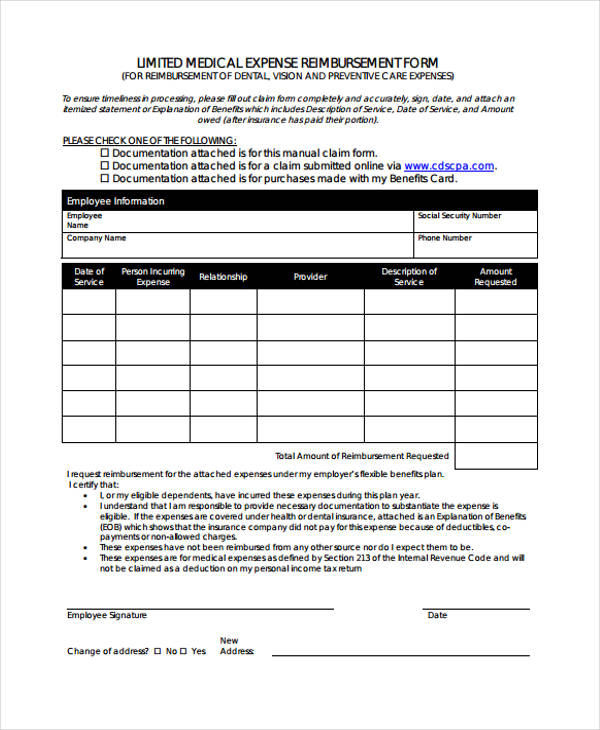

Free 11 Medical Expense Forms In Pdf Ms Word

Publication 502 2021 Medical And Dental Expenses Internal Revenue Service

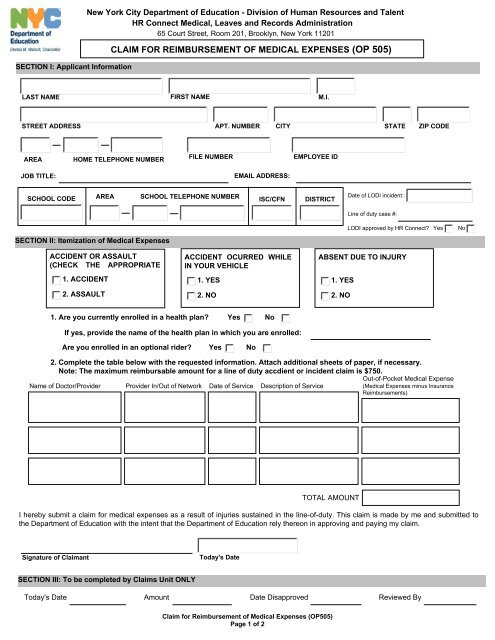

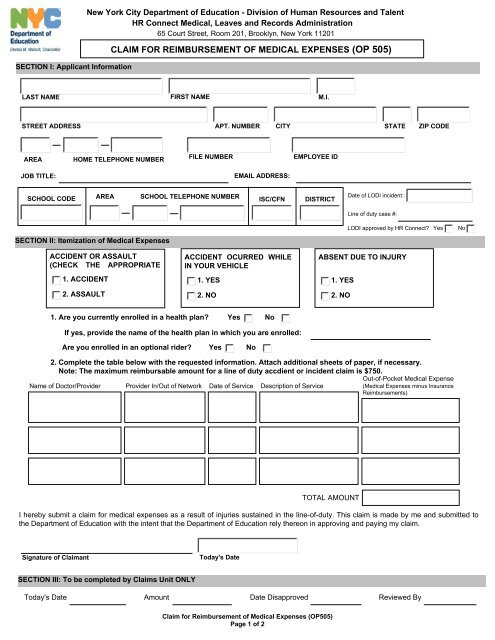

Claim For Reimbursement Of Medical Expenses Op 505

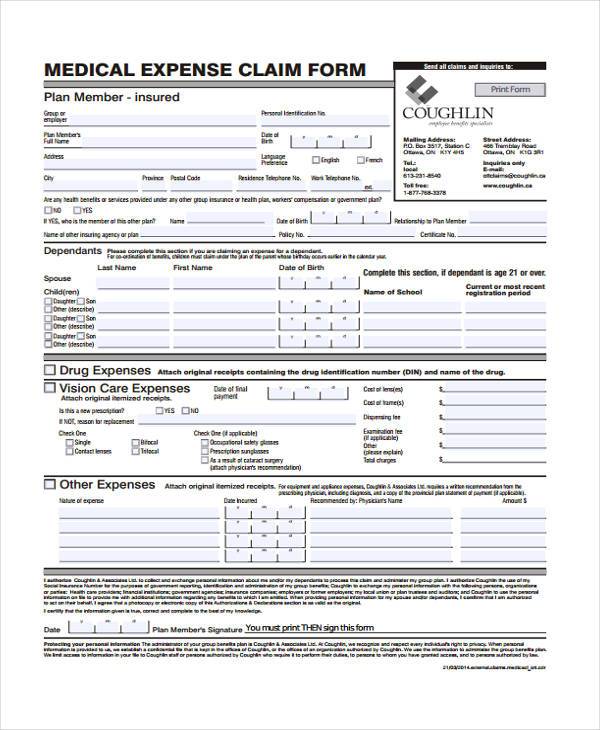

Claim Form For Medical Expenses Short Version

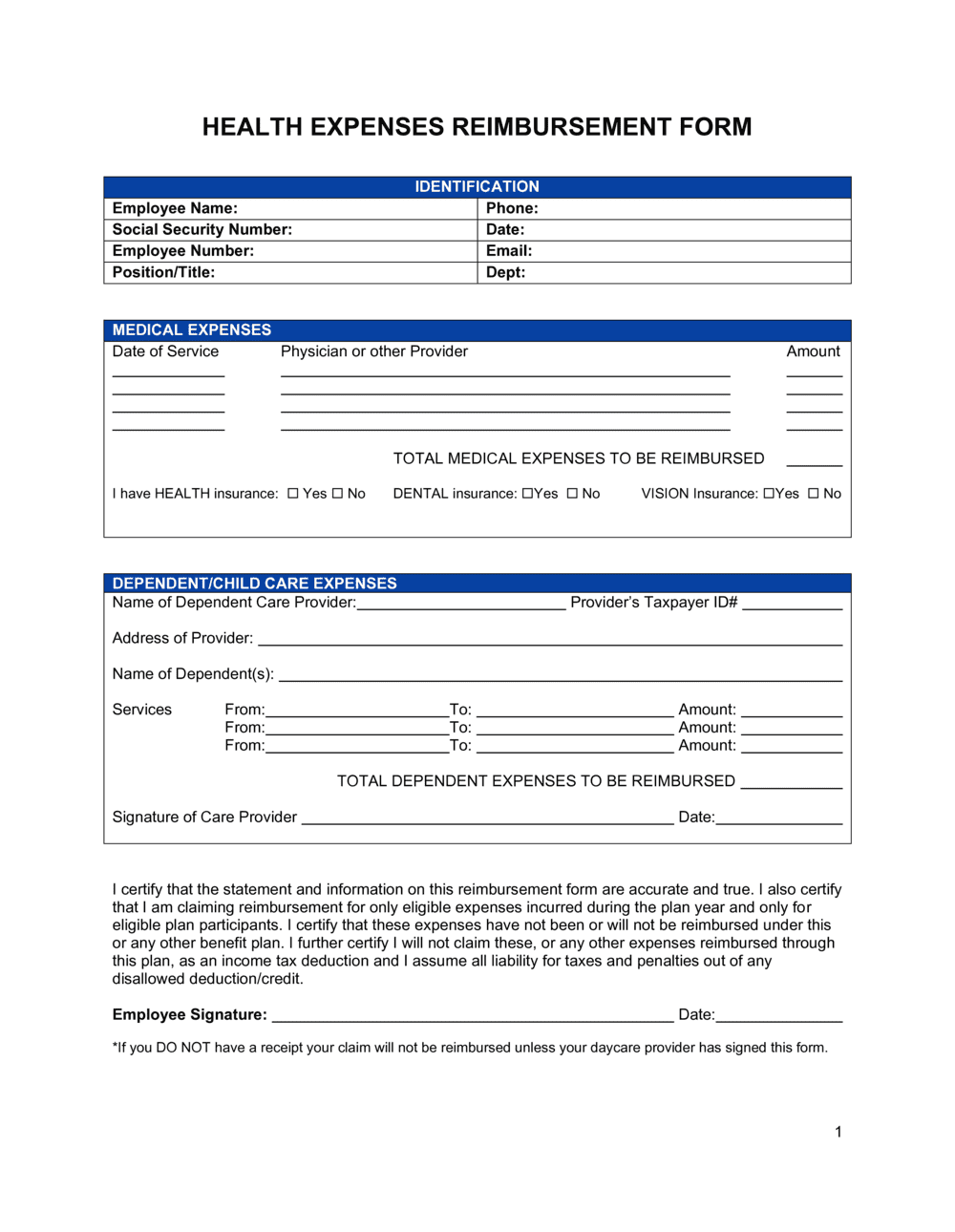

Reimbursement Form Medical Expenses Template By Business In A Box

0 Response to "how to claim medical expenses"

Post a Comment